Manage Corporate Insurance Claims

Run every corporate policy service request and claim in one governed workspace so you protect margins, prove compliance, and keep enterprise clients informed.

Run every corporate policy service request and claim in one governed workspace so you protect margins, prove compliance, and keep enterprise clients informed.

Bring every policy change, coverage question, and claim into a single governed workspace. See the full story by client, policy, and program. Decisions stand up in reviews while your servicing and claims teams move quickly and stay aligned.

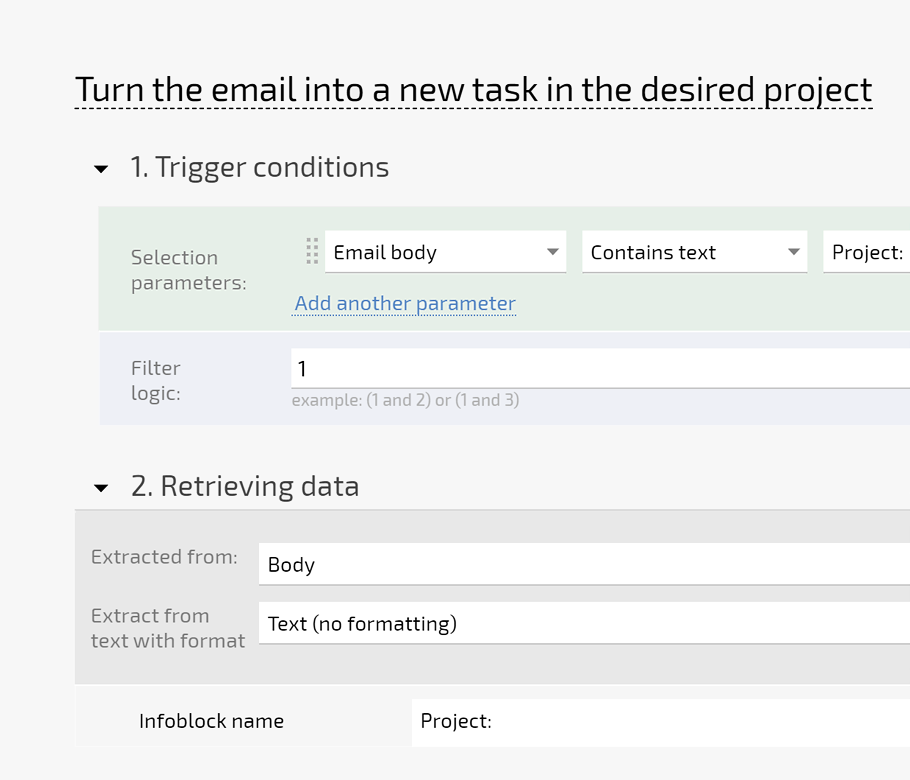

Begin by routing all servicing and claim signals into Planfix. Connect shared mailboxes and channels, use email to task conversion, and let AI Agents extract policy data into fields. You get one clean list of active cases in Planner.

You jump between inboxes, core systems, and ad hoc trackers just to understand what is going on. Ownership is fuzzy, cases bounce between teams, and you worry that something important is stuck, forgotten, or about to explode before renewal.

Connect email, telephony, calendars, messengers, and storage so cases stay governed while data flows across your stack.