Track Due Diligence Portfolio

Run every diligence checklist, post investment task, and portfolio follow up in one governed Planfix workspace so deals stay disciplined, value plans ship, and IC and LP questions are easy to answer.

Run every diligence checklist, post investment task, and portfolio follow up in one governed Planfix workspace so deals stay disciplined, value plans ship, and IC and LP questions are easy to answer.

BRING ORDER TO DILIGENCE AND POST INVESTMENT WORK

You run multiple deals, workstreams, and portfolio companies while questions and follow ups scatter across email, chat, and spreadsheets. Planfix gives you one governed workspace for each deal and company where tasks, documents, decisions, and communication stay linked to the right record.

START WITH THE FASTEST WIN

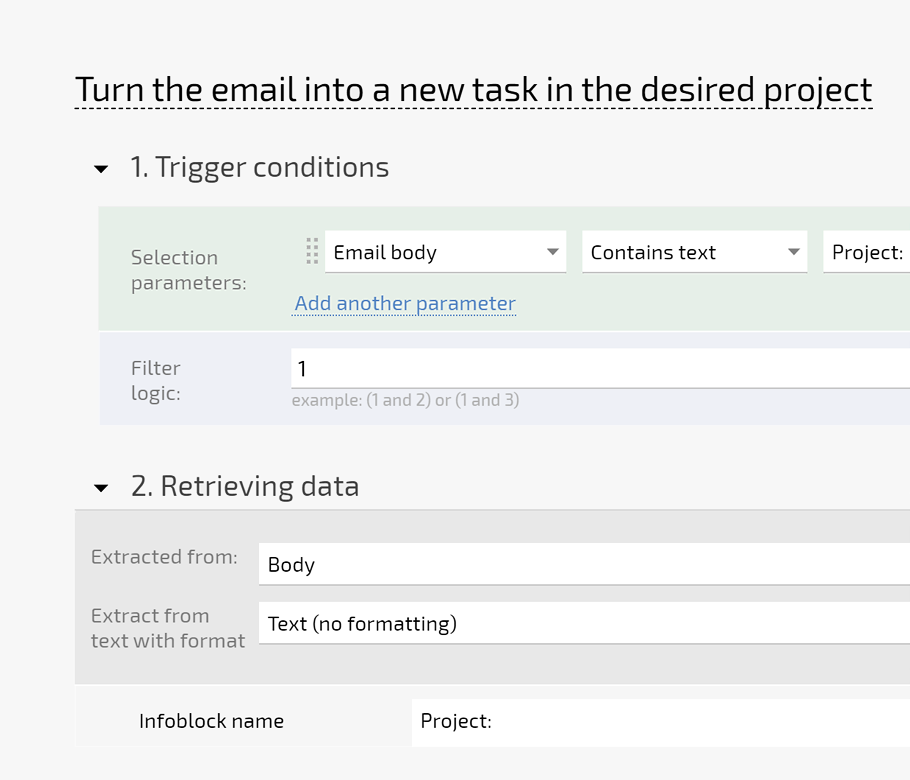

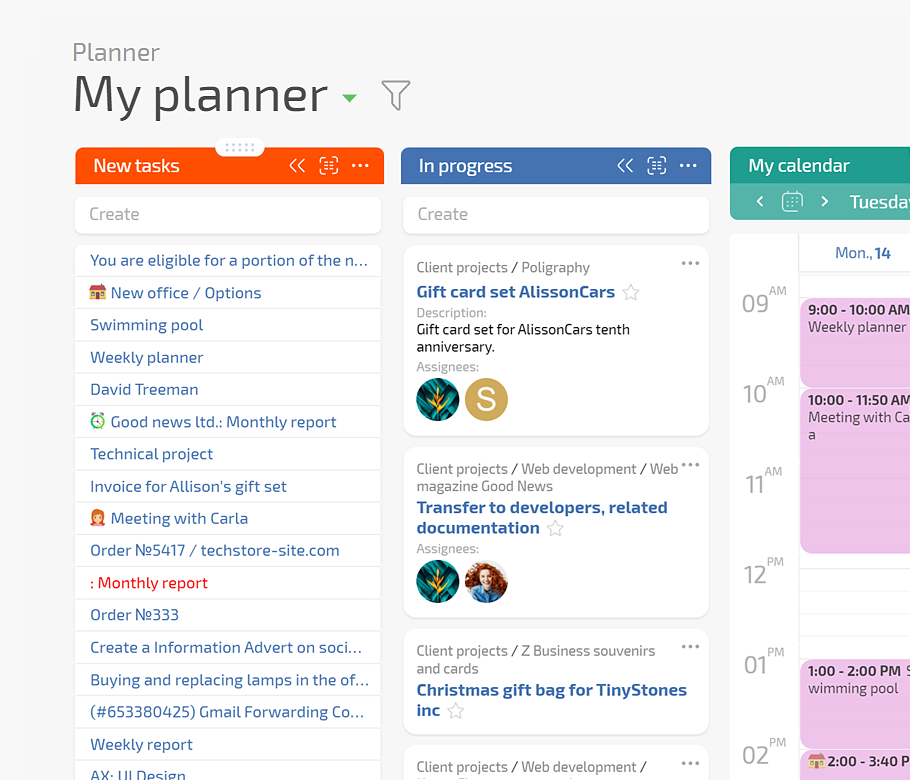

Begin with one live deal and a Planner board. Forward founder, advisor, and lawyer email threads into Planfix so each conversation becomes a task. Drag tasks between conditional lists to update status, owner, and priority in a single move.

CREATE A CLEAR MOMENT OF CONTROL

Watch a Planner board show every open diligence item by deal and workstream in real time. Add an AI summarizer agent to key tasks so decision makers see a live brief of findings and next steps instead of chasing updates.

FROM REACTIVE HUSTLE TO OPERATING MODEL

You move from ad hoc hustle to a repeatable operating model where every deal and portfolio company lives in the same governed workspace. Diligence checklists, conditions, and value creation plans are traceable so you feel calm before committees and confident when LPs ask about follow through.

Connect mail, data rooms, calendars, calling, and reporting so deal teams work from one system of record.